DKK 18 million from IRFD for the department’s researchers

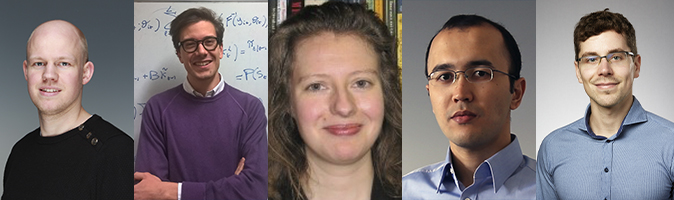

Rune Majlund Vejlin, Leopoldo Catania, Nicola Maaser, Bezirgen Veliyev and Phillip Heiler from the Department of Economics and Business Economics receive DKK 18 million from the Independent Research Fund Denmark.

Five researchers from the Department of Economics and Business Economics are awarded grants from Independent Research Fund Denmark, Social Sciences.

Professor Rune Majlund Vejlin is awarded a Research project 2 grant of DKK 6.2 million for his project Causes of Lifetime Income Inequality. The research project deals with differences in lifetime incomes in Denmark.

"I am very happy with the grant. It will enable us to gain a much deeper understanding of how big the differences in lifetime incomes in Denmark are and which economic mechanisms lie behind these differences. This is important to know both for us as economists, but also if you as a politician have an ambition to reduce the differences," says Rune Majlund Vejlin.

More about Rune Majlund Vejlin’s project

The research project deals with differences in lifetime incomes. We will first examine the actual differences in lifetime incomes in Denmark, how they have developed over generations, and whether these differences are driven by developments in the educational composition in Denmark and / or developments in the composition of the industry.

The project also examines determinants of differences in the probability of finding a job when unemployed, as time spent without work is one of the primary determinants of differences in lifetime earnings. One of the questions we will investigate is whether long-term unemployment occurs because some individuals find it very difficult to find a job, or because the probability of finding a job decreases with time spent in unemployment, and that this is the reason why it is very difficult for the long-term unemployed to find a job.

Another determinant of how long an individual spends in unemployment is how likely they are to lose their job. We will investigate whether this probability varies across companies, so that some companies have a high propensity to dismiss employees, or whether differences are primarily due to individual propensities to be dismissed.

Finally, we will gather the insights from the above projects into a unified economic model. The model will be used to investigate what the primary causes of differences in lifetime income are.

Associate professor Leopoldo Catania is also awarded a Research project 2 grant of DKK 6.2 million for his project A New Way to Estimate Probability Densities and Understand Uncertainty. Once his new method is established, Leopoldo Catania’s research group will focus on empirical applications, including the estimation and the prediction of measures of uncertainty for the real and financial economy.

More about Leopoldo Catania’s project

Over the last century, researchers concluded that we must include measures of uncertainty in our predictions to have a complete characterization of the phenomenon of interest. The Bank of England in 1997 popularized this concept in economics by including “fan charts” in its famous annual Inflation reports. The estimation and prediction of such measures of uncertainty is complicated in social sciences due to observability constraints. Indeed, differently from natural sciences, controlled experiments in macro and financial economics cannot be designed. Available methods to deal with these observability constraints often rely on very restrictive assumptions.

The aim of this research project is to develop a new method that relies on less restrictive assumptions. This method is made possible thanks to recent advancements in econometrics. Once the new method is established, the research group will focus on empirical applications. These empirical applications include the estimation and the prediction of measures of uncertainty for the real and financial economy. We expect that policymakers will gain substantially from our project, which will allow them to approach relevant policy questions using a completely new methodology that does not rely on restrictive assumptions, like in the current practice. The same holds for investors that operate on the international financial markets and rely on quantitative risk manager techniques. This includes both private and institutional investors.

Associate professor Nicola Maaser is granted a Research project 1 grant of DKK 2.9 million for her project Value in Diversity? Effort and Performance in Group Decision-making. Her findings will provide a basis for designing groups and decisions to achieve well-informed decisions and less dishonest actions.

“I am very excited and happy to receive this grant. It will allow me to help better determine when cultural and ethnic diversity in a group, such as a work team or expert panel, is beneficial or detrimental to the quality of decisions. I hope that a better understanding of the dynamics in diverse groups will lead to actionable insights for team composition and communication and, eventually, better organisational performance,” says Nicola Maaser.

More about Nicola Maaser’s project

When does cultural and ethical diversity enhance or detract from the quality of group decisions made in, for example, working groups, expert panels, and political committees? The research project uses economic theory, game theory, and laboratory experiments to shed light on this question.

It focuses on informational and ethical decision quality. Informational quality is at stake when good decisions depend on decision-makers putting effort into obtaining information before making a decision. Ethical quality matters when groups decide on dishonest actions; relevant examples are boards of directors deceiving consumers about a product's health risks or falsifying financial statements.

The project's findings will provide a basis for designing groups and decisions to achieve a high probability of well-informed decisions or a low incidence of dishonest actions. They will thus be valuable in areas such as public administration, management, and legislation.

Associate professors Bezirgen Veliyev and Phillip Heiler are co-PIs on their project Novel Methods for Partial Identification in Observational and Experimental Studies. They have received a Research project 1 grant of DKK 2.8 million. They will provide novel methodological contributions under the paradigm of partial identification.

“We feel very privileged to be awarded this grant. This is fantastic news. The research will benefit the credibility of research practice for public policy evaluation and beyond that operate without imposing unnecessarily strong assumptions. We are excited to getting started on the project,” Bezirgen Veliyev and Phillip Heiler state.

More about Bezirgen Veliyev and Phillip Heiler’s project

Quantitative evaluation of policy interventions and treatments is at the heart of data-driven, evidence-based public policy debates. However, even with the same data sources, researchers often arrive at different or opposing conclusions and policy recommendations due to different assumptions. In this proposal, we provide novel methodological contributions under the paradigm of partial identification. This allows us to relax assumptions and provide a framework of transparency for empirical research. We develop cutting-edge methodology and remove major technical and practical barriers to a more widespread adoption in observational and experimental studies.

Further info

- Read IRFD’ press release (in Danish)

- Read IRFD’s article about Rune Majlund Vejlin and his research project (in Danish)

Read more about the researchers and their research on their PURE profiles: